The Compliance Dashboard Revolution: From Data Overload to Actionable Insights

Discover how modern compliance dashboards transform complex data into clear, actionable insights.

The Evolution of Compliance Dashboards: From Static Reports to Dynamic Insights

In an era characterized by escalating regulatory complexity, expanding global operations, and an ever-increasing volume of digital data, the discipline of compliance has undergone a profound transformation. What was once a largely manual, reactive, and often overwhelming exercise in documentation and periodic reporting has evolved into a strategic imperative requiring real-time visibility and proactive management. At the heart of this evolution lies the modern compliance dashboard, a technological leap that has fundamentally reshaped how organizations approach, monitor, and master their regulatory obligations. These dashboards are no longer mere repositories of static reports; they are powerful, dynamic decision-making platforms, capable of distilling vast quantities of granular data into readily digestible, actionable insights. This shift represents a revolutionary change, moving compliance from a burdensome cost center to a source of strategic advantage.

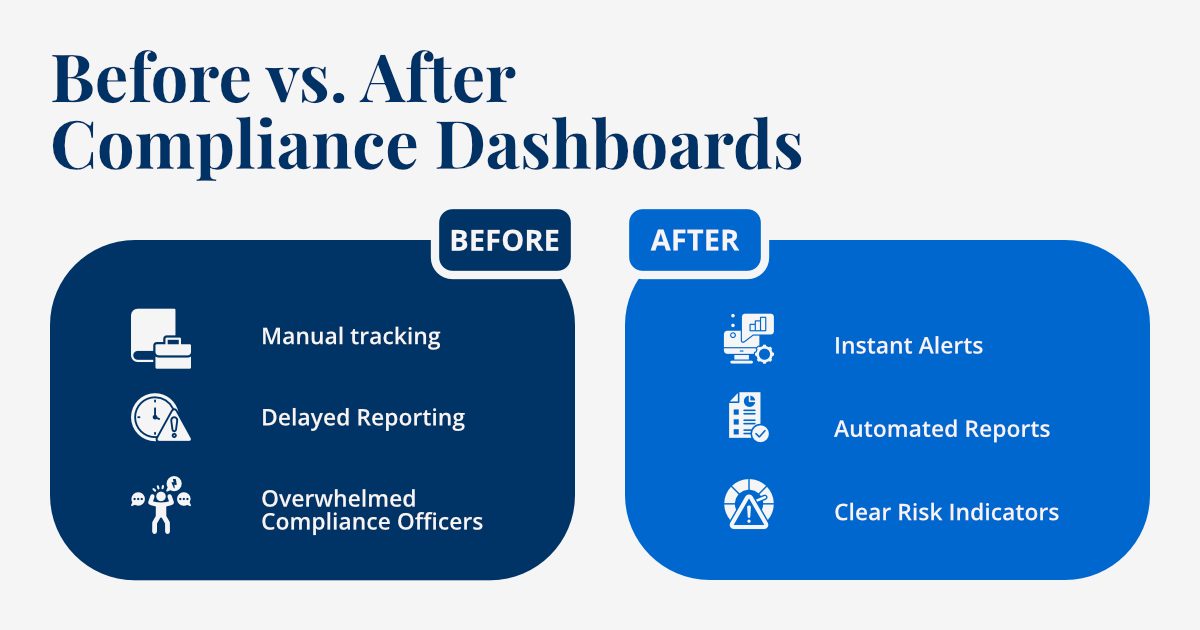

Historically, compliance involved wading through stacks of spreadsheets, sifting through disparate data sources, and attempting to piece together a coherent picture of an organization's adherence to various rules and regulations. This traditional approach was inherently inefficient, prone to human error, and often yielded outdated information by the time it was compiled. Such methods made it nearly impossible to identify emerging risks promptly or to demonstrate continuous compliance effectively. In today's data-driven environment, where regulatory frameworks are constantly evolving and the volume of data generated by business operations is immense, these traditional approaches are simply untenable. Organizations are now leveraging sophisticated data analytics, advanced visualization techniques, and real-time monitoring capabilities to turn what was once an overwhelming influx of complex compliance data into clear, concise, and ultimately actionable insights that empower swift and informed decision-making.

The tangible benefits of this shift are not merely theoretical; they are quantifiable. Recent studies and industry benchmarks provide compelling evidence of the profound impact modern compliance dashboards have on organizational effectiveness and risk mitigation. For instance, reports indicate that organizations that have successfully implemented and utilized modern compliance dashboards report a remarkable 75% improvement in their decision-making speed related to compliance matters. This acceleration is crucial in dynamic regulatory environments, allowing companies to adapt quickly to new mandates or to address identified deficiencies before they escalate into serious issues. Furthermore, these organizations have observed a significant 60% reduction in compliance-related incidents, such as fines, penalties, or breaches. This reduction is a direct consequence of the enhanced visibility, proactive identification of potential risks, and the ability to intervene decisively based on real-time data. These statistics underscore that the compliance dashboard revolution is not just about technology; it's about fundamentally rethinking and optimizing the entire compliance function for greater efficiency, accuracy, and strategic impact. The following sections will delve into the specific features and benefits that drive this transformative change.

Key Dashboard Features

The transformative power of modern compliance dashboards stems from a suite of advanced features designed to overcome the limitations of traditional compliance management. These essential capabilities empower organizations to not only monitor their compliance posture effectively but also to proactively identify risks and make data-driven decisions. They move beyond simple data aggregation to provide truly intelligent insights.

Real-time Monitoring and Alerts

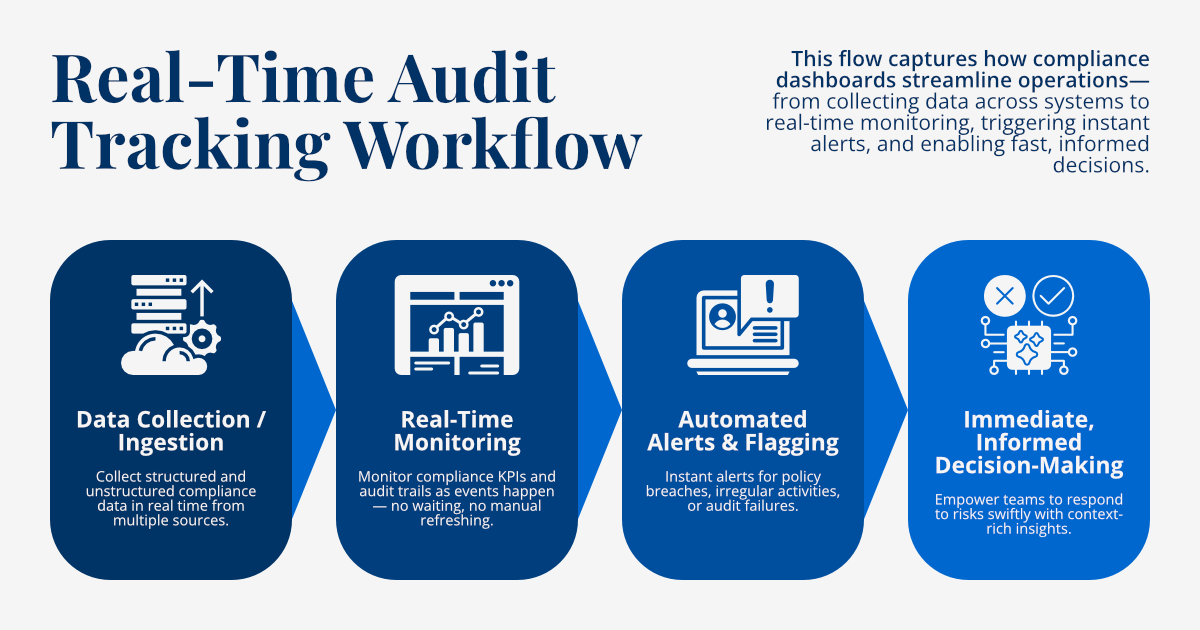

One of the most impactful features of modern compliance dashboards is their capability for real-time monitoring. Unlike static reports that offer a snapshot of a past moment, these dashboards provide continuous tracking of critical compliance metrics, key performance indicators (KPIs), and regulatory obligations as they evolve. This involves integrating with various source systems—from enterprise resource planning (ERP) systems to customer relationship management (CRM) platforms, and security information and event management (SIEM) tools—to ingest data continuously. When predefined thresholds are exceeded, or potential violations are detected, the system generates instant, automated alerts. These alerts can be configured to notify relevant stakeholders via email, SMS, or directly within the dashboard interface. This proactive notification mechanism is crucial for rapid response, allowing compliance teams to address potential issues immediately, before they escalate into significant incidents, fines, or reputational damage.

Interactive Data Visualization and Drill-Down Capabilities

Beyond simple reporting, modern compliance dashboards excel at transforming complex, raw data into intuitively understandable visual representations. This is achieved through interactive charts, graphs, heatmaps, and other dynamic visualization tools. These visualizations are not static images; they allow users to explore compliance data from multiple angles, applying filters, drilling down into specific metrics, or cross-referencing different datasets. For example, a user might view an overall compliance score, then click on a particular area (e.g., "data privacy") to see sub-scores, then drill down further to identify specific policy violations or non-compliant activities. This deep-dive capability empowers compliance officers, risk managers, and even executive leadership to quickly identify trends, pinpoint root causes of non-compliance, and understand the context behind headline figures. This interactivity moves users beyond passive consumption of data to active engagement, fostering a deeper understanding of the organization's compliance posture.

These key features, when combined, create a powerful synergy that transforms compliance management from a reactive, laborious process into a proactive, insightful, and strategic function. They enable organizations to not only meet regulatory obligations but also to gain a competitive advantage by operating with greater transparency, efficiency, and reduced risk.

Benefits of Modern Dashboards

The adoption of advanced compliance dashboards delivers a multitude of tangible benefits that extend far beyond mere regulatory adherence. Organizations that successfully implement these sophisticated tools report significant improvements across various operational and strategic dimensions, fundamentally reshaping their approach to governance, risk, and compliance (GRC). These benefits underscore why modern compliance dashboards are becoming an indispensable component of effective business management.

- 50% faster decision-making: The ability to access critical compliance data and insights in real-time dramatically accelerates the decision-making process. Compliance officers no longer have to wait for weekly or monthly reports to understand their posture. Instead, they can immediately identify emerging issues, assess their potential impact, and initiate corrective actions or policy adjustments with unprecedented speed. This agility allows organizations to respond proactively to regulatory changes or internal anomalies, preventing minor issues from escalating into major compliance failures. This rapid response capability is a significant competitive advantage in today's fast-paced business environment.

- 75% reduction in manual reporting: Traditional compliance reporting is notoriously labor-intensive, consuming countless hours of staff time in data collection, aggregation, formatting, and manual validation. Modern compliance dashboards largely eliminate this burden through automated data collection, integration from various source systems, and sophisticated visualization engines. This automation frees up valuable human resources, allowing compliance professionals to shift their focus from tedious administrative tasks to higher-value activities such as strategic risk analysis, policy development, and stakeholder engagement. The efficiency gains translate directly into cost savings and a more strategically engaged compliance function.

- 90% improvement in data accuracy: Manual processes are inherently prone to human error, leading to inconsistencies, omissions, and inaccuracies in compliance documentation and reports. Automated data validation and verification processes embedded within modern dashboards significantly mitigate these risks. Data is ingested, processed, and presented with minimal human intervention, ensuring a much higher degree of integrity and reliability. This enhanced accuracy means that decisions are based on solid, dependable information, reducing the likelihood of errors that could lead to non-compliance, fines, or operational disruptions. The confidence in data accuracy also greatly improves audit readiness and the defensibility of compliance efforts.

In summary, the benefits of embracing modern compliance dashboards extend far beyond simply meeting regulatory obligations. They empower organizations to operate with greater agility, efficiency, and precision, transforming compliance from a necessary evil into a powerful strategic asset that contributes directly to business resilience and growth.

Implementation Strategies

While the benefits of modern compliance dashboards are compelling, their successful implementation is not merely a matter of purchasing software. It requires a thoughtful and strategic approach that addresses data integration, user experience, and ongoing management. A well-executed implementation strategy ensures that the dashboard becomes a valuable and indispensable tool, rather than an underutilized technology.

Clear Data Integration Strategy

The effectiveness of any compliance dashboard hinges on the quality and comprehensiveness of the data it receives. Therefore, developing a clear and robust strategy for integrating data from multiple, often disparate, sources and systems is paramount. This involves identifying all relevant data points across various departments (e.g., HR, IT, legal, finance, operations), understanding their formats, and establishing secure, efficient data pipelines. Data governance is crucial here, ensuring data quality, consistency, and proper categorization. Many organizations struggle with data silos, where critical information resides in isolated systems. A successful integration strategy leverages APIs, connectors, and potentially data warehousing solutions to pull all necessary compliance-related data into a unified platform. This foundational step ensures that the dashboard reflects a complete and accurate picture of the organization's compliance posture, preventing incomplete insights or blind spots.

User-Friendly Design and Customization

Even with the most robust data backend, a dashboard's utility is limited if its interface is not intuitive and user-friendly. The design should prioritize clarity, simplicity, and ease of navigation, ensuring that complex compliance data is accessible and actionable for all relevant users, regardless of their technical expertise. This includes features like customizable widgets, drag-and-drop functionality for report building, and personalized views that allow different stakeholders (e.g., CISO, Head of Legal, Department Managers) to see the metrics most relevant to their responsibilities. Effective user experience also involves thoughtful use of color coding, graphical elements, and clear labeling to highlight critical information and potential risks. Regular feedback from end-users during the development and iteration phases is essential to refine the design and ensure it meets their specific needs and workflows, thereby maximizing adoption and usage.

Beyond these core strategies, successful implementation also involves ongoing training for users, establishing clear ownership of the dashboard and its underlying data, and a commitment to continuous improvement based on evolving regulatory landscapes and organizational needs. By carefully planning and executing these strategies, organizations can unlock the full potential of compliance dashboards, transforming them into indispensable tools for proactive risk management and strategic decision-making.

Conclusion: The Future of Compliance Management

The landscape of regulatory compliance is dynamic, ever-expanding, and increasingly complex. In this environment, relying on outdated, manual processes for managing compliance is no longer sustainable. The emergence and widespread adoption of modern compliance dashboards represent a fundamental revolution in how organizations approach governance, risk, and compliance (GRC), shifting the paradigm from reactive firefighting to proactive, intelligent oversight. These sophisticated tools are not just technological enhancements; they are strategic necessities for any organization aiming to thrive amidst stringent regulatory demands.

By embracing advanced visualization techniques, powerful analytics, and, most crucially, real-time monitoring capabilities, organizations can achieve unprecedented levels of compliance visibility and control. What was once an overwhelming deluge of disparate data can now be transformed into clear, concise, and immediately actionable insights. This capability empowers leadership and compliance teams alike to swiftly identify potential deviations, anticipate emerging risks, and make informed, data-driven decisions that safeguard the organization against financial penalties, reputational damage, and operational disruptions. The ability to drill down into specific areas of concern, track trends over time, and understand the root causes of non-compliance offers a depth of insight previously unattainable.

Looking ahead, the future of compliance management is undeniably digital, automated, and insight-driven. Modern compliance dashboards are at the forefront of this evolution, serving as the central nervous system for an organization's GRC efforts. They enable a continuous compliance posture, where monitoring is ongoing, risks are identified as they emerge, and remediation efforts are swift and targeted. This proactive approach not only ensures adherence to regulatory obligations but also fosters a culture of compliance throughout the organization, embedding risk awareness into daily operations. For businesses seeking to navigate the complexities of the modern regulatory environment with confidence, efficiency, and strategic foresight, investing in and effectively utilizing a robust compliance dashboard is not merely an option—it is an imperative for sustainable growth and long-term success.