Regulatory Compliance in Banking: Using AI to Stay Ahead of Changing Requirements

Learn how AI solutions help banking institutions adapt to evolving regulatory landscapes.

The Evolving Banking Regulatory Landscape: A Complex Challenge

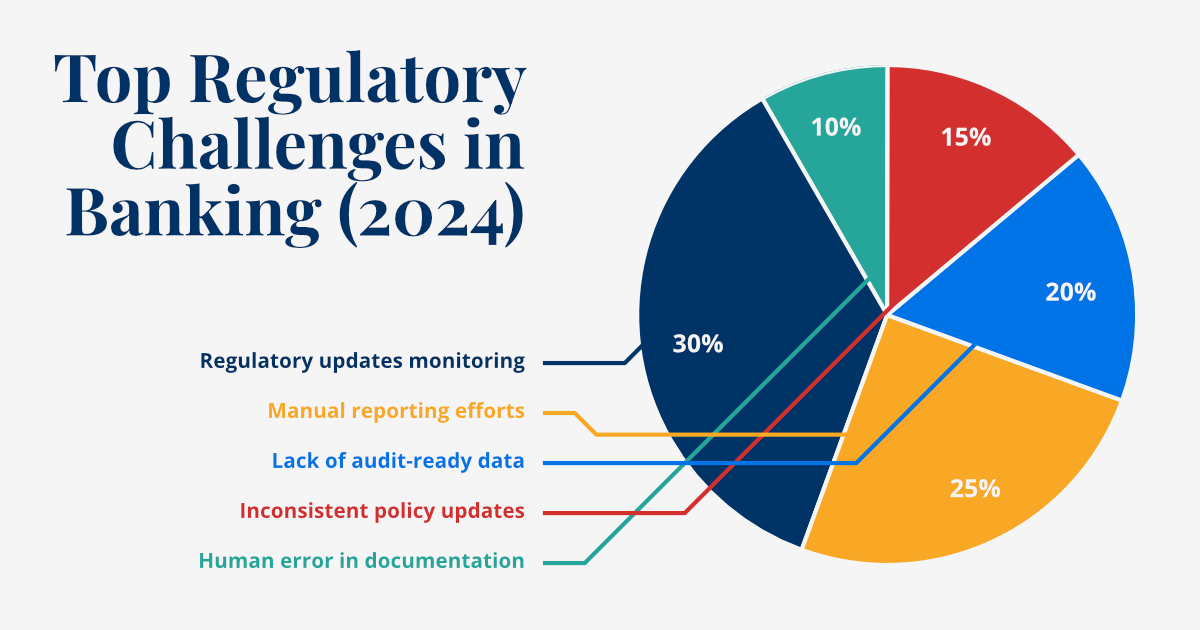

The banking industry faces unprecedented regulatory challenges. With new requirements emerging on a near-daily basis, financial institutions must constantly adapt to a complex web of regulations. This ongoing challenge requires maintaining robust operational efficiency, ensuring unimpeachable data integrity, and crucially, preserving the invaluable trust of their customers and stakeholders. The traditional approach to compliance management, often characterized by manual processes, extensive human review, and reactive responses, is no longer sustainable in today's rapidly evolving regulatory environment. This manual approach is inherently slow, prone to human error, and struggles to keep pace with the sheer volume and velocity of regulatory changes.

The stakes are incredibly high. Non-compliance can lead to severe penalties, including hefty fines that can run into billions, reputational damage that takes years to rebuild, and even limitations on business operations. Furthermore, the global nature of modern finance means that regulations are not confined to a single jurisdiction but often involve a patchwork of international standards and local requirements, adding layers of complexity. Staying ahead is not just about avoiding penalties; it's about building a resilient, trustworthy, and efficient financial institution that can adapt and thrive in an increasingly scrutinized landscape. The pressure on compliance teams has never been greater, and without innovative solutions, they risk being overwhelmed by the sheer scale of the task.

Consider the sheer volume of regulatory text issued globally each year – it's a monumental task for any human team to process, interpret, and implement. Manual processes are simply too slow to react to these changes in a timely manner, opening the door to non-compliance periods. This gap between regulatory issuance and effective implementation is precisely where significant risk lies. This comprehensive overview will delve into the specific challenges posed by the current regulatory climate and demonstrate how artificial intelligence (AI) is providing a transformative pathway for banking institutions to not only meet but exceed these evolving compliance demands, transforming compliance from a reactive burden into a strategic advantage.

Recent Regulatory Changes: Impact and Implications

The financial regulatory landscape is a dynamic one, constantly reshaped by global events, technological advancements, and shifts in economic policy. Banking institutions must navigate a complex web of regulatory updates, each carrying significant implications for their operations, risk management, and client relationships. Recent key regulatory updates illustrate the heightened scrutiny and demand for more robust compliance frameworks. Understanding these changes is the first step toward effective adaptation.

- Enhanced Due Diligence: Stricter requirements for customer verification and risk assessment have become paramount. This mandates more comprehensive data collection and sophisticated analysis of customer profiles, transaction patterns, and beneficial ownership. The aim is to combat financial crimes such as money laundering and terrorist financing. This necessitates not just collecting more data, but having the capacity to make sense of it, identify patterns, and flag anomalies at scale. Manual processes often lead to incomplete profiles or missed red flags due to the sheer volume of information.

- Vendor Risk Management: More stringent guidelines for third-party oversight are now in force. Banks are increasingly responsible for the actions and compliance of their vendors, necessitating comprehensive vendor assessment and continuous monitoring throughout the entire vendor lifecycle. This includes assessing cybersecurity risks, data privacy protocols, and operational resilience of every third party involved in the bank's operations. The complexity of managing hundreds or thousands of vendor relationships manually makes this a daunting task, increasing the risk of weak links in the supply chain.

- Real-time Monitoring: Regulators are increasingly mandating continuous compliance monitoring. This requires immediate detection and reporting of potential violations or suspicious activities as they occur, rather than after the fact. Traditional batch processing or periodic reviews are no longer sufficient. This shift demands a proactive, always-on approach to identifying anomalies and potential breaches, requiring sophisticated analytical capabilities that human teams alone cannot provide at scale.

- Expanded Reporting: There are increased requirements for detailed documentation and regular, often highly granular, compliance reporting to regulatory bodies. This includes everything from anti-money laundering (AML) reports to consumer protection disclosures and financial stability assessments. The volume and specificity of these reports demand highly accurate and well-organized data, making manual compilation a significant drain on resources and a source of potential errors. The ability to generate these reports quickly and accurately is now a critical operational capability.

These changes collectively underscore the need for a paradigm shift in how banks approach compliance. The sheer volume of data, the speed of regulatory updates, and the demand for real-time vigilance make manual, siloed processes obsolete. Financial institutions must embrace advanced technological solutions to navigate this complex environment effectively, ensuring both adherence to regulations and the efficient allocation of their valuable human capital.

AI-Powered Compliance Solutions: Transforming Banking Operations

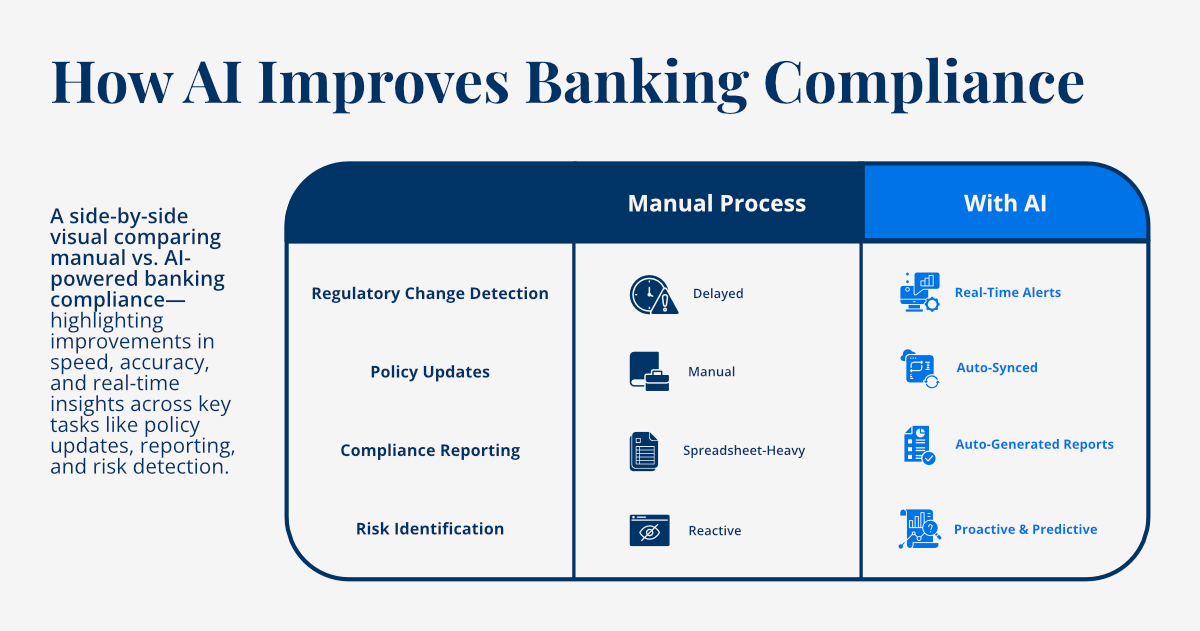

The challenges posed by the evolving regulatory landscape in banking are precisely where modern AI solutions demonstrate their transformative power. By leveraging sophisticated algorithms, machine learning, and natural language processing (NLP), AI addresses these complexities with unprecedented efficiency, accuracy, and foresight. These technologies are not just automating existing tasks; they are fundamentally redefining how banks achieve and maintain compliance, turning a burden into a strategic advantage.

Automated Regulatory Change Monitoring

AI systems continuously monitor regulatory updates from hundreds of global sources, including legislative bodies, regulatory agencies, and industry forums. Using advanced natural language processing (NLP), they can automatically parse, interpret, and assess the impact of these new requirements on existing processes and internal policies. This ensures timely compliance with new mandates, significantly reducing the time and resources traditionally spent on manual research and interpretation, allowing compliance teams to focus on implementation rather than discovery.

Intelligent Compliance Assessment

Advanced algorithms analyze vast volumes of transaction data, customer interactions, and operational activities in real-time. This allows them to identify potential compliance issues, anomalies, or suspicious patterns that might indicate fraud, money laundering, or other illicit activities. By identifying these issues before they escalate into full-blown violations, AI empowers banks to take proactive measures, minimizing risk and ensuring adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations with a level of precision and speed impossible with human review alone.

Predictive Risk Analysis

Leveraging sophisticated machine learning models, AI can analyze historical compliance data, market trends, and external indicators to predict potential compliance risks. This foresight enables banks to develop proactive risk mitigation strategies, allocate resources more effectively, and reinforce controls before issues materialize. Predictive analytics move compliance from a reactive function to a forward-looking, strategic capability, helping institutions anticipate and prepare for future regulatory challenges and potential areas of vulnerability.

Automated Documentation and Reporting

AI systems streamline the laborious process of generating comprehensive compliance reports and maintaining detailed audit trails. They can automatically collect, organize, and format necessary data, ensuring that all regulatory requirements are met efficiently and accurately. This significantly reduces the manual effort involved in audit preparation, mitigates the risk of human error in reporting, and ensures that banks are always audit-ready with complete, verifiable documentation, a critical factor for demonstrating adherence to regulatory bodies.

These AI-powered solutions work in synergy to create a comprehensive, robust, and dynamic compliance framework. They allow human compliance professionals to shift their focus from mundane, repetitive tasks to high-value strategic analysis, interpretation of complex regulatory nuances, and the development of proactive risk mitigation strategies. This strategic reallocation of human capital is one of the most significant benefits of AI in banking compliance.

Implementation Success Stories: Real Results from Leading Institutions

The theoretical benefits of AI in regulatory compliance are now being substantiated by tangible results from leading financial institutions worldwide. Early adopters of AI-powered compliance solutions are reporting significant and measurable improvements across various critical metrics, demonstrating the profound impact of this technology on operational efficiency, risk reduction, and overall compliance posture. These success stories are not just anecdotal; they reflect a strategic shift towards more intelligent and automated compliance management.

Faster Regulatory Adaptation

A notable 40% reduction in the time required to implement new regulatory requirements has been observed. This accelerated adaptation ensures timely compliance and significantly reduces operational risks associated with delayed implementation. By automating the identification and initial assessment of new regulations, banks can drastically shorten the cycle from regulatory issuance to operational readiness, minimizing the window of potential non-compliance and keeping them ahead of the curve.

Reduced Compliance Violations

There has been a remarkable 75% decrease in compliance violations through proactive monitoring and automated risk detection systems. AI's ability to analyze vast datasets in real-time and identify subtle anomalies allows banks to detect and rectify potential issues before they become full-blown violations. This proactive approach significantly reduces the likelihood of regulatory fines and reputational damage, demonstrating a strong commitment to compliance.

Streamlined Audit Preparation

A significant 50% reduction in audit preparation time has been achieved through automated documentation and evidence collection processes. AI platforms can quickly assemble comprehensive audit trails, gather relevant data, and format reports, drastically cutting down the manual effort and time traditionally spent by compliance teams. This efficiency frees up valuable human resources for more strategic analysis and problem-solving, enhancing overall audit readiness and responsiveness.

Enhanced Documentation Accuracy

An impressive 90% improvement in documentation accuracy has been reported through automated validation and verification processes. AI minimizes human transcription errors, ensures data consistency, and flags any discrepancies or missing information immediately. This level of accuracy is critical for maintaining reliable records for regulatory scrutiny, building trust in your compliance processes, and avoiding errors that could lead to non-compliance issues down the line.

These compelling results highlight that AI is not just a theoretical solution but a proven asset for banking compliance. The real-world impact underscores its capacity to mitigate risk, improve efficiency, and transform compliance from a reactive overhead into a proactive, value-generating function within financial institutions. The ability to demonstrate such significant improvements also strengthens a bank's reputation with regulators and customers alike.

Strategic Implementation: Building a Future-Ready Compliance Framework

The successful implementation of AI-powered compliance solutions in banking requires more than just purchasing software; it demands a comprehensive and strategic approach. This strategy must consider both the technical integration of AI tools and the necessary organizational shifts to maximize their effectiveness. A well-planned implementation ensures that AI becomes a seamless, integrated component of your compliance framework, rather than a standalone solution.

- Comprehensive Assessment: Begin by conducting a thorough evaluation of your current compliance processes. Identify existing pain points, manual bottlenecks, areas prone to human error, and opportunities for automation. This assessment should pinpoint specific regulatory challenges that AI is best positioned to address, creating a clear roadmap for implementation. Understanding your current state is crucial for defining your future-state success.

- Technology Integration: Seamlessly integrate AI solutions with your existing core banking systems, data repositories, and other enterprise software. This ensures a unified flow of information and prevents the creation of new data silos. Robust API connectivity and a modular architecture are key to achieving this seamless integration, allowing AI to access and process the vast amounts of data it needs to be effective without disrupting current operations.

- Team Training and Upskilling: Provide comprehensive training to your compliance, legal, and IT teams to ensure effective utilization of the new AI tools. This includes not just technical training on how to operate the systems, but also education on how AI enhances their strategic roles. Upskilling your team to interpret AI-generated insights and leverage automated workflows is vital for maximizing the return on your AI investment and fostering user adoption. Compliance professionals become "AI-augmented" experts.

- Continuous Monitoring and Optimization: Implement ongoing performance tracking and optimization for your AI models and compliance workflows. Regulatory requirements, market conditions, and even threat landscapes are constantly evolving, so your AI solutions must adapt. Regular reviews, model recalibration, and feedback loops are essential to ensure the AI remains effective and efficient in identifying new risks and adapting to changing compliance demands. This iterative process guarantees long-term relevance.

- Regulatory Alignment and Governance: Ensure that your AI solutions are continuously aligned with evolving regulatory requirements and internal governance policies. Establish clear oversight mechanisms, ethical guidelines for AI use, and processes for validating AI outputs. This proactive alignment ensures that AI-driven insights are trusted and defensible, and that the technology consistently supports your regulatory obligations rather than inadvertently creating new risks.

By adopting this holistic approach, financial institutions can build a future-ready compliance framework that is not only robust and efficient but also scalable and adaptable to whatever regulatory challenges lie ahead. This strategic implementation ensures that AI truly becomes an integral part of your operational fabric, driving continuous improvement and sustainable compliance. It transforms compliance from a reactive cost center to a proactive strategic advantage that strengthens the entire organization.

Conclusion: Embracing AI for Sustainable Compliance

In an era defined by rapid regulatory change and heightened scrutiny, AI-powered compliance solutions are no longer an optional luxury for banking institutions—they are an absolute essential. The inherent limitations of traditional, manual compliance processes are becoming increasingly apparent, exposing financial institutions to significant risks, operational inefficiencies, and missed strategic opportunities. By embracing the transformative capabilities of artificial intelligence, banks can decisively move beyond these historical constraints.

Implementing AI solutions allows financial institutions to fundamentally transform their compliance function from a reactive, resource-intensive cost center into a dynamic, proactive, and invaluable strategic advantage. This shift empowers banks to not only maintain stringent regulatory compliance with unparalleled accuracy and speed but also to build a more resilient and trustworthy enterprise. The ability to quickly adapt to new regulations, proactively identify potential risks, and streamline complex reporting requirements provides a significant competitive edge in today's fast-paced financial landscape.

Furthermore, investing in AI for compliance demonstrates a forward-thinking commitment to responsible financial stewardship and ethical operations. It enhances customer trust by minimizing errors and ensuring robust data protection, while also improving relationships with regulatory bodies through transparent and verifiable compliance processes. The future of banking compliance is undeniably intelligent and automated, leading to sustainable growth, enhanced operational efficiency, and a strengthened position in the global financial market. This strategic adoption of AI is not just about staying compliant; it's about leading the way.